“We did it for you!” says Tax Committee while making life harder for ordinary people by slashing duty-free limits

In a move that will hit ordinary citizens squarely in the pocket, Uzbekistan's Tax Committee has issued a statement defending the government’s decision to drastically reduce duty-free import limits – insisting, without a hint of irony, that the policy is being enacted “exclusively for the benefit of society.”

Officials argue that the new measures are aimed at curbing so-called “shuttle traders” and increasing revenues through the growth of legal entrepreneurship. They also claim the changes bring Uzbekistan’s customs regime in line with international norms.

As reported earlier, starting May 1, Uzbekistan is significantly cutting the amount of goods individuals can bring into the country duty-free. In a statement justifying the changes, the Tax Committee cited economic instability, global inflation, and disruptions to international trade as reasons for the reform.

“With a forecasted $3.5 trillion decline in global trade and inflation rising to 7.5–8% worldwide, we are taking bold steps based on our internal capacities. This resolution aims to support domestic producers and exporters, create a fair competitive environment, and foster entrepreneurship,” the statement reads.

A convenient comparison with global practices

The committee noted that Uzbekistan’s previous duty-free allowances were “too generous” compared to other countries. For example, the EU sets air travel limits at $480 and land travel at $330. In Turkey, the limit is $480 regardless of the method of entry, and in China, it's $722.

Now, under the new rules, if a citizen crosses the border by land and has been abroad for less than two days, or flies but stays abroad for fewer than three days, they will no longer qualify for duty-free exemptions.

Officials were quick to point out that similar practices exist in countries like Singapore, the U.S., Turkey, Brazil, and Argentina, where flat customs fees apply to all goods brought in under such circumstances.

The convenient “shuttle trader” scapegoat

The Tax Committee accused some individuals of abusing the current system by repeatedly crossing the border and bringing in goods under the guise of personal use.

“Some cross the border up to 100 times a month, bringing in commercial goods as personal items. In Tashkent airport alone, over 500 such passengers import up to 2–3 tons of goods annually,” the statement claims.

They also emphasized that administrative and criminal penalties already exist for illegal imports disguised as non-commercial goods. So far in 2024, nearly 600 individuals have been caught engaging in such activities, with 1,190 attempts to smuggle goods worth a total of 21 billion UZS through the so-called “green corridor.”

New courier limits: From $1000 to $200

The changes don’t stop at border crossings. Starting May 1, individuals will only be allowed to receive up to $200 worth of goods per month through courier services without paying duties – down from the previous $1000 per quarter.

The committee says the $200 threshold reflects the current average value of courier packages. They compared this limit with those in other countries: China ($288), South Korea ($150), Georgia ($125), Ukraine (€100), the UK ($188), and EU nations ($41–$175). Unlike many of these countries, the committee added, Uzbekistan doesn’t charge VAT on such imports – yet.

Authorities also claim that many courier shipments marked “not for sale” were in fact part of commercial schemes. Between 2023 and 2024, they documented 1,100 such violations totaling 8.3 billion UZS. In one case, a single individual received 408 packages in one year.

Courier traffic to Uzbekistan exploded in 2024, with more than 5.7 million packages worth $167 million delivered – three times the volume of 2023. Officials say packages were sometimes addressed to deceased individuals or people unaware that shipments were made in their name, using falsified documents and stolen personal data.

“For the people,” of course

“These measures align Uzbekistan with international standards and are vital for ensuring a healthy competitive environment and reducing the shadow economy,” the Tax Committee concluded.

And, in a final flourish of bureaucratic gaslighting:

“Most importantly, these changes are exclusively for the good of our society. They will boost incomes through legal business activity, ensure steady economic growth, support entrepreneurship, create new jobs, and lead to the construction of kindergartens, schools, hospitals, infrastructure – and ultimately improve the living standards of our people.”

Related News

18:34 / 26.05.2025

Uzbekistan launches new tax inspectorate to enforce product labeling rules

16:55 / 15.05.2025

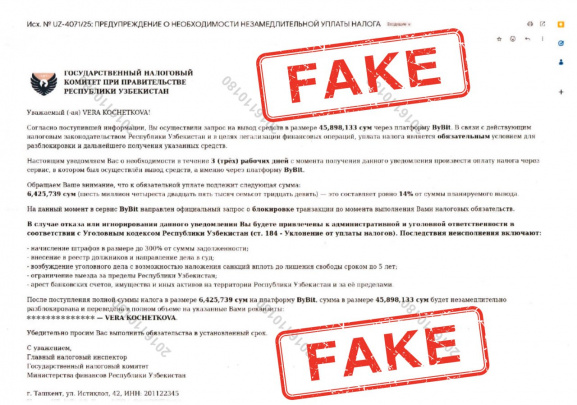

Tax Committee warns of fraudulent emails about tax debt

13:18 / 13.05.2025

Gov’t plans to tax bloggers earning from online ads

20:57 / 05.05.2025