The grey market loophole: How China’s ‘zero-kilometer’ cars reach Central Asia

Cars known as “zero-kilometer vehicles” have never been driven, yet they are being exported to markets such as Russia, Central Asia (including Uzbekistan), and the Middle East under the guise of used cars. This practice allows Chinese automakers to offload vehicles that are difficult to sell domestically and supports their expansion efforts.

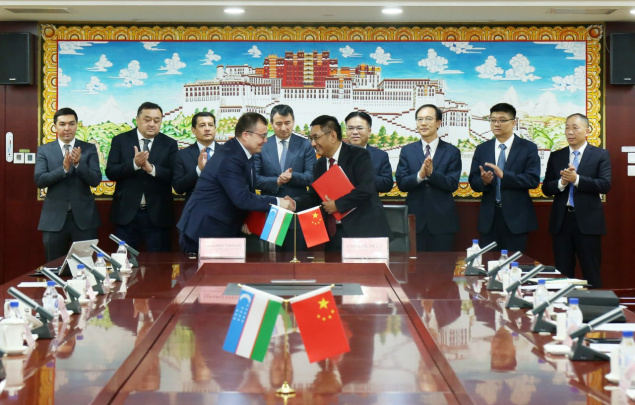

Photo: Getty Images/Bloomberg

According to Reuters, China’s booming automotive industry has for years benefited from a state-supported grey market that boosts vehicle sales. In this scheme, brand-new cars are registered straight off the production line and then exported abroad as "used" vehicles.

The so-called “zero-kilometer” cars are sold abroad despite having never been used. They are mainly sent to Russia, Central Asia, and the Middle East as second-hand vehicles. This enables Chinese manufacturers to clear out stock that is hard to sell at home, effectively bypassing domestic market saturation.

This controversial practice drew national attention in China after the head of Great Wall Motor publicly criticized the sale of “zero-kilometer” vehicles within the country in May. On June 10, People’s Daily – a publication that typically reflects the stance of the Chinese Communist Party – condemned the domestic sale of these pseudo-used vehicles. The newspaper accused the practice of artificially driving down prices during an ongoing price war in the auto industry and called for "strict measures" to restore order.

Despite domestic backlash, the export and sale of these “fake used” cars are actively encouraged by regional governments across China. Local authorities have embraced the scheme as a means of contributing to Beijing's ambitious economic growth plans.

The export process of “zero-kilometer” used vehicles operates as follows: once a new car rolls out of the factory, an exporter purchases it directly from the manufacturer or a dealer, registers it under a Chinese license plate, and immediately classifies it as a used car for export. The manufacturer then logs the sale and records the revenue.

Such practices by local governments would make little sense outside China’s centrally planned economy. However, showcasing rapid growth in sales and employment can attract new investments or subsidies. Moreover, local officials may risk dismissal if they fail to meet Beijing’s economic targets.

This export model emerged after 2019, when China permitted the export of used vehicles to other countries.

According to the China Passenger Car Association, the country overtook Japan in 2023 to become the world’s largest exporter of new vehicles. In 2024, China exported 6.41 million vehicles, approximately 6% of which were “zero-kilometer” cars.

Two dealers and two industry experts noted that these “zero-kilometer” vehicles typically run on gasoline and do not sell well in China. However, a significant portion of them are electric vehicles that benefit from generous government subsidies.

Related News

11:19 / 08.08.2025

Uzbekistan’s electric vehicle imports surge, driven by Chinese manufacturers

11:59 / 07.08.2025

China National Gold Group to extract precious metals and critical minerals in Uzbekistan

15:24 / 06.08.2025

Sanitary Committee rules out chikungunya outbreak in Uzbekistan

17:41 / 02.08.2025